Concentrated Stock

Quarterly Update

Q1 2023

Highlights

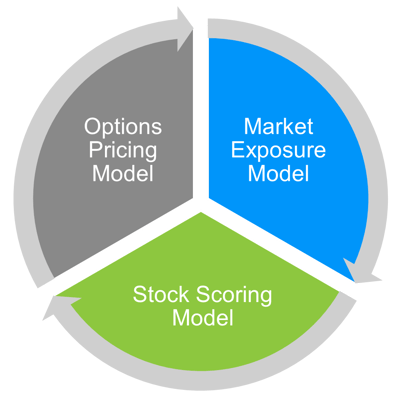

- The Federal Reserve raised rates 50 basis points so far this year, with one more hike projected for 2023; accordingly, our market exposure model remains conservative.

- Our stock scoring model incorporates lower Q1 earnings and reduced sentiment.

- Option premiums pulled back as volatility nears 52-week lows.

- Portfolio Insights: the effect of volatility on option premiums for NorthCoast’s covered call strategies.

Senior Vice President

Portfolio Management

Market Exposure Model

Stock Scoring Model

Options Pricing Model

What is Volatility and Why Should it Matter?

Option pricing models, such as the Black-Scholes-Merton (BSM) model, use several variables to estimate the price of options. BSM requires six inputs: the strike price, current stock price, time to expiration, risk-free interest rate, dividend yield, and volatility. Last quarter, we talked about the impact higher interest rates have on the upside potential for covered calls1. This time, we explore the relationship between forecasted volatility and option premiums.

In March 2020, markets endured exceptionally high stress due to the Covid-19 pandemic. Implied volatility, as measured by the VIX index, recorded its highest level since its inception in 1990, shortly after President Trump announced a travel ban to the US from Europe. Covid’s peak VIX reading was even higher than during the Global Financial Crisis (GFC) in 2008. While the VIX has since declined, we have seen frequent shocks due to macroeconomic and geopolitical issues. Rising inflation, increasing interest rates, the Russia-Ukraine conflict, constricted oil supply, and other events have reintroduced market pressures.

As mentioned, volatility and option pricing are positively related, predicated on the assumption that when a stock is highly volatile, its options are more likely to go into the money, therefore giving the options greater value. We can illustrate this point by observing UnitedHealth Group (UNH). UNH’s stock plunged alongside the overall market in March 2020. Its biggest one-day drop was on March 16, 2020, when the stock dropped 17.2%. What followed was a series of erratic daily price swings. By the third week of March, the stock had suffered a 35% drawdown2.

The dark blue line in the above graph, resembling a seismograph that measures the strength of earthquakes, shows the day-over-day price changes, in percent, of UNH stock. The biggest price shock occurred on March 16, 2020, with several “aftershocks3” in the weeks after. Implied volatility measures the standard deviation of future expected returns by the current supply and demand of the stock’s options. Therefore, UNH's volatility, represented by the shaded gray area, almost immediately jumped from around 20% (pre-Covid) to 94%. This big spike was effectively the market’s forecast of UNH’s forward-looking price action. The stock, however, quickly recovered following guidance from management4, and the daily price swings subsided.

In the next section, we discuss how market stress influences option yields for NorthCoast’s covered call strategies.

4 Losev, Glen M. “UnitedHealth Guidance Eases Covid-19 Concern: Earnings Outlook.” Bloomberg Intelligence, 15 Apr. 2020.

Portfolio Insights: The Effect of Volatility on Option Premiums for Our Covered Call Strategies

One of our main offerings for concentrated stock clients is the Covered Call Strategy. The purpose of the strategy is to generate option premiums by selling call options against the underlying stock. The premiums produced from the strategy are largely influenced by volatility in the market.

Continuing with the UNH example, we created a scatterplot of UNH volatility and call option premiums, as estimated by the Black-Scholes-Merton model, to illustrate the relationship between the two variables using a sampling of UNH options dated 2019 to 2023. Next, we graphed a linear regression. As indicated by the R2 ("r-squared"), volatility and premiums carry a strong correlation of 86%.

The dots at the right of the graph, with volatilities between 40% and 50%, represent periods of extreme stress. Not surprisingly, they occurred during the 2020 and 2021 Covid period. With covered calls strategies, the higher the call prices, the greater the option yields.

Since then, volatility has trended down, albeit with periodic spikes. The VIX ended the first quarter near its 1-year lows.

What happened? Markets were comforted by recent Fed comments that rate hikes will soon level off; accordingly, volatility is down. But with recession indicators climbing higher, continued uncertainty in the markets, and prolonged elevated interest rates, we believe that option yields should rebound and that the current market environment should continue to be attractive for covered call strategies.

Interested in how Concentrated Stock Triple Play may help your portfolio?

Contact your NorthCoast advisor or email us at info@northcoastam.com.