Concentrated Stock

Quarterly Update

Q2 2023

Highlights

- Equity markets continue to rally this year as second quarter GDP and May inflation came in better than expected.

- Our stock scoring models remain conservative as valuation ratios appear stretched and projections show two more interest rate hikes in 2023.

- Option models steer toward higher strike prices due to market momentum.

- Portfolio Insights: NorthCoast’s no-call-away provision for concentrated stock positions

Senior Vice President

Portfolio Management

Market Exposure Model

Stock Scoring Model

We are currently underweight tech for several reasons. The sector’s recent price action appears to be highly speculative, therefore, valuation ratios seem lofty. Other considerations supporting our conservative posture are the current interest rate environment, the possibility of mean-reversion given recent momentum, and consumer confidence lingering well below its baseline level.

Options Pricing Model

What Happens to Covered Call Strategies in an Up Market and What Can We Do About It?

US equities are experiencing one of the longest bear market rallies in history. Nasdaq is up 38.7% for the year, while the S&P 500 and Dow are up 15.9% and 3.8%, respectively. Just a handful of technology firms are contributing much of those returns. Overall, 8 out of 11 S&P 500 sectors are positive for the year.

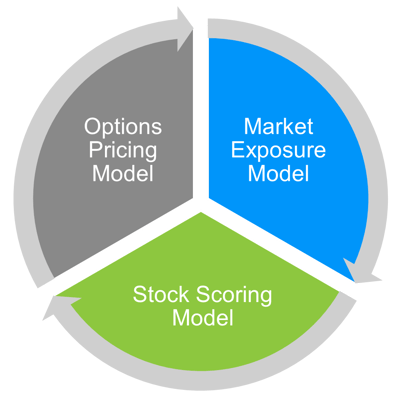

When market action is strong, it’s critical that your portfolio manager is ready to respond if necessary. Our investment team uses proprietary tools and models which we believe deliver a competitive advantage in managing concentrated stock portfolios. The market exposure and stock selection models use current and historical data to help us gauge future performance. Accordingly, we select strike prices and expiration dates based on those models’ outputs, as well as risk assessment and upside potential.

Active management is key. If risk levels exceed internal guideposts, the team may strategically roll options prior to expiration to mitigate risk. Options are more likely to go in-the-money (ITM) in an up market, and those that are deep ITM with less time to expiration have a higher likelihood of being exercised. In these situations, the team may preemptively take these steps:

- Close existing options

- Gain/loss neutrally sell shares if the client is interested in partially liquidating the position

- Adjust contract durations based upon market conditions

- Reset strike prices higher

- Generate premiums from new covered calls

Conversely, if risk levels are within an acceptable range, we may hold off.

Even with daily monitoring of positions, options may still be exercised. Here is what happens following a covered call options exercise:

- Shares are “called away” or “assigned”

- Client receives proceeds equal to the number of shares called-away multiplied by the strike price

- Client usually realizes a gain on the called-away shares

Portfolio Insights: The No-Call-Away Provision for Concentrated Stock Positions

There is always some risk that covered call options are exercised with shares called away. Risk increases when a position is deep in-the-money and close to expiration. However, options can theoretically be exercised at any time, and sometimes irrationally, i.e., when it doesn’t make financial sense to do so.

Under certain circumstances, NorthCoast may have contingency measures available to protect our clients’ shares. Upon receiving notice of share assignment, and after confirming with the advisor or client, we may buy back shares at market open the next business day at the prevailing price. Next, the custodian delivers the newly purchased shares to the option holder. In this process, the client keeps their shares with the original cost basis, and they should not realize stock gains because of the exercise1.

Here is an example using a concentrated stock position in Chevron (CVX). On January 26, 2022, we wrote June 2022 covered calls with a $150 strike price which allowed for 19% upside. The next month, Russia invaded Ukraine. Markets expected a downside shock to global oil supplies, and crude oil futures prices jumped in response. Oil company stock prices followed suit.

What happened? After an initial spike, volatility started to retreat in March 2022 and CVX’s price leveled off. But one month before expiration, a holder of the June 2022 $150 calls exercised the options and the shares were assigned. The next day, we bought back the quantity of assigned shares, which were delivered to the option holder. The shares with the original cost basis remained in place. Finally, we wrote new November 2022 covered calls with a higher $220 strike price which allowed for 27% further upside and generated additional option premium.

Interested in how Concentrated Stock Triple Play may help your portfolio?

Contact your NorthCoast advisor or email us at info@northcoastam.com.