Concentrated Stock

Quarterly Update

Q2 2024

Highlights

- Equity market indices ended the second quarter near all-time highs following improving inflation reports

- Stock scoring models reflect weakening valuation metrics as equity prices continue to climb

- Clients of concentrated stock solutions are opting for more upside potential rather than higher option premiums

- Portfolio Insights: Introduction to NorthCoast’s Triple Play Strategy, A Multi-Faceted Approach to Options Strategies

Senior Vice President

Portfolio Management

Market Exposure Model

Equities continued to advance in June following more evidence of cooling inflation and renewed expectations of policy rate cuts. The S&P 500 and the Dow climbed by 3.6% and 1.2%, respectively, while the technology-heavy Nasdaq outperformed by rallying 6.0% for the month. Markets seem optimistic about the outlook of easing policy, pricing in two interest rate cuts this year, while the median dots from the FOMC suggested only one cut. We believe that we are in a higher-for-longer interest rate environment and expect a shallow path for rate cuts, given prospects for moderate economic growth and a bumpy road towards slower inflation. Also, there is an extreme level of stock concentration, with the largest 20 stocks accounting for 75% of S&P 500 gains year to date. While we expect technology to continue fueling economic growth, we remain cautious and view this trend as unlikely to be sustained. Overall, we anticipate a bumpy process in the “last mile” on inflation, high for longer policy rate, and moderating growth. With this backdrop, we maintained an allocation to U.S. equities at 48%.

Stock Scoring Model

Of the top holdings within the Concentrated Stock portfolios, our stock scoring model had a hit rate (or “success rate”) below average last quarter. The model generally predicted neutral or underperformance against the Invesco Equal Weight Index (RSP). We anticipated that iPhone manufacturer Apple (AAPL) would outperform due in large part to management behavior. Shares rallied following CEO Tim Cook’s positive comments on plans to expand the usage of AI (artificial intelligence) in its devices and record $110 billion share repurchase announcement. Shares outperformed RSP by 25% during the quarter.

Outlook on UnitedHealth (UNH) was neutral. Medical costs and operating expenses have grown significantly higher. Earlier this year, the company fell victim to a cyberattack and the U.S. Department of Justice launched an antitrust investigation into the company. However, shares pared losses from the early part of Q2 when it was reported that earnings and revenues beat estimates. Shares outperformed the RSP by 6.0% in Q2.

Options Pricing Model

A Rising Tide Lifts All Boats

Readers of the NorthCoast Navigator may have noted the investment team’s conservative posture. Throughout the first quarter, valuations generally appeared lofty, sentiment was neutral to positive, technicals were positive, and, as mentioned above, macroeconomic fundamentals were neutral. But, in addition to these concerns, other factors driving market outlook included the conflict in the Middle East and upcoming US presidential election.

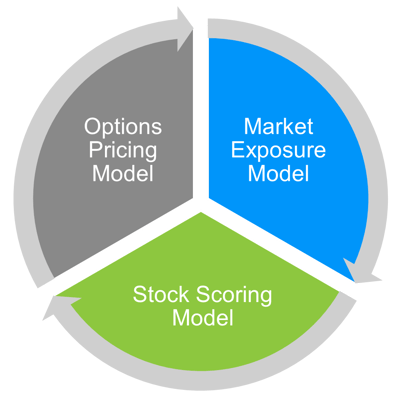

The macro view influences how we manage concentrated stock portfolios. This top-down view underscores NorthCoast’s competitive advantage—specifically, the team’s use of proprietary investment models and active trade implementation. While these models projected some headwinds, strong performance in key sectors such as technology, communication services, and utilities drove benchmarks to record highs. But the market exposure score is just one component. We also utilize a stock score, which appraises future performance based on several different factors. Both are then incorporated into our options pricing model.

These tools allow us to employ dynamic and tactical portfolio management. We’ll show how all this comes together in the following section.

Portfolio Insights: NorthCoast’s Triple Play Strategy, A Multi-Faceted Approach to Options Strategies

While some investment advisors may implement a market-agnostic style when managing option overlay portfolios, the NorthCoast team employs the Triple Play strategy, which incorporates market outlook, stock score, and option pricing models to help select optimal options contracts.

Market Exposure Score

The first input is the market exposure score. At the start of Q2, our score was 57%, a conservative outlook. The score ranges between 0% and 100%. The higher the score, the more optimistic the model outlook. The lower the score, the more pessimistic the outlook.

One of the reasons for this score is that valuation metrics for equity remained negative. Price-to-earnings (P/E) ratios (historical and forward) inched higher. Sentiment was also negative. U.S. manufacturing activity contracted. The University of Michigan Consumer Confidence Index fell sharply as elevated gasoline prices and stubborn inflation weighed on consumer outlook. Technical indicators were positive, with encouraging momentum signals outweighing neutral reversal signals. Further, the S&P 500 was 12% above its 200-day moving average. The VIX (volatility index) was relatively flat with low realized volatility. Lastly, macroeconomic fundamentals were neutral. Nonfarm payrolls rose by 272,000 in May, stronger than consensus expectations. The initial jobless claims drifted upwards, with the four-week moving average edging up to 236,000 as of June 22.

Stock Score

Stock scores are based on valuation, comprehensive value versus peer group, sentiment, institutional attention, market efficiency, technical indicators, and management behavior. These components make up the composite score. A higher score indicates a greater confidence level of outperformance, whereas a lower score estimates greater likelihood of underperformance.

To illustrate, our score on NVIDIA (NVDA) earlier this year was 87%. The company is known primarily for designing and manufacturing graphics processing units (GPUs). NVDA made headlines last year following blowout earnings due to the AI revolution and demand for its products. Valuation, relative value versus peer group, and management behavior looked positive. Additionally, the company saw four consecutive quarterly earnings beats (when earnings were greater than expectations), strong top-line revenue growth with net profits, and positive guidance.

Options Pricing Model

In the first half of the year, we observed several spikes in the implied volatility of NVDA call options, and a higher figure typically leads to greater option yields. We used these opportunities to capture attractive option premiums and keep strike prices elevated while the outlook on NVDA was positive.

Putting Together the Pieces

The below graph shows NVDA’s price over the past year with changes in outlook and option trades. When projections for the market and NVDA were positive, we maintained a high level of strike prices or moved even higher. When the outlook was negative, we opted to lock in option gains, moderately lower strike prices to capture more yield, and roll options further out for additional cash flow.

Our experience has shown that incorporating a market view and stock score is a more effective way of managing covered call option strategies.

Interested in how Concentrated Stock Triple Play may help your portfolio?

Contact your NorthCoast advisor or email us at info@northcoastam.com.