Concentrated Stock

Quarterly Update

Q3 2023

Highlights

- After hitting year-to-date highs, equities reversed course during the third quarter as higher interest rates weighed on markets

- Our stock scoring model estimates weaker Q3 and Q4 earnings

- Investors are increasingly turning to put options to hedge against recession fears

- Portfolio Insights: Why active management for options strategies is essential in today’s economic environment

Senior Vice President

Portfolio Management

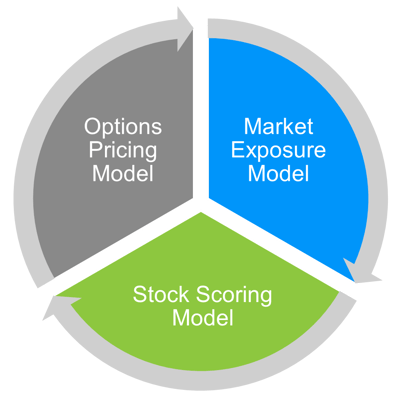

Market Exposure Model

We continue to hold the view that the resilient economy and persistent inflation call for sustained restrictive monetary policy. Given this backdrop, we have maintained a cautious approach, reducing our US equity exposure from 52% to 40% during the month.

Stock Scoring Model

The model is currently underweight names like Uber (UBER) which tend to underperform in recessions. Conversely, we’re bullish on several names within the discretionary sector, such as Amazon (AMZN) and Netflix (NFLX), which historically have better withstood economic headwinds.

Options Pricing Model

Responding to Changing Tides

In August, Fitch downgraded US sovereign debt from AAA to AA+ on the deterioration of governance quality over the past 20 years. Perpetual budget deficits, political infighting, and threats of a government shutdown were some of the reasons behind the decision. Further, sentiment eroded due to the wars between Israel and Hamas as well as Russia and Ukraine, as these conflicts tend to have destabilizing effects on global economies.

Recession fears remain elevated. Rising bond yields have pushed investors into safe assets, leading to a pullback in equities. Markets are facing periodic spikes in volatility due to geopolitical conflicts and evolving economic reports. The University of Michigan Consumer Confidence Index fell again in September, as rising gasoline prices and the declining equity market weighed on confidence. Our forecast calls for potentially narrower profit margins, weakened balance sheets, and a mild economic slowdown. Demand for downside protection, i.e., put option positioning, has jumped. A put is a form of insurance. The put / call ratio, a measurement of the open interest in puts versus calls, has steadily increased into bearish territory since the previous quarter.

However, there is some positive news. Core inflation was down to 4.1% from its peak of 6.6% in September. Additionally, there have been improvements in GDP growth and employment forecasts. But this may give the FOMC justification to raise rates. Traders are currently expecting one more quarter-point rate hike this year with the first cut projected in May 2024.

Active management for an options portfolio is important in this type of environment. The NorthCoast portfolio management team evaluates market conditions and relies on its proprietary investment models to seek out trading opportunities in uncertain environments. Based on the outputs of our market exposure and stock scoring models, we recommend trade execution that serves our clients’ best interest.

In the next section, we demonstrate how NorthCoast employs this dynamic approach to options.

Portfolio Insights: Creating Value through Active Management

NorthCoast’s strategy in managing covered calls is to utilize active oversight, a unique take on traditional options trading.

In last quarter’s article, we discussed the circumstances under which the NorthCoast team tactically executes options trades in a client’s account (see “What Happens to Covered Call Strategies in an Up Market and What Can We Do About It?”).

The core idea is to close options that have breached internal risk thresholds. One scenario is rolling2 out-of-the-money (OTM) options into new options to produce an additional stream of premiums, but in a risk-aware manner. Alternatively, we may take advantage of the increasing underlying stock price to roll in-the-money (ITM) options early and into higher strike prices. This is to better protect the underlying position from call-away risk and to secure higher upside potential. Timing is important. Waiting to roll OTM options could reduce total premiums collected (opportunity cost) and waiting until the option is too deep ITM may significantly increase the net cost to roll.

The below graph illustrates our covered call trades for a concentrated position in Tesla (TSLA). The period chosen shows how the option overlay was managed when TSLA was up, down, and sideways. The green and red dots specify when the options had drifted below or above the internal thresholds.

What happened? After TSLA’s lackluster start in 2021, we decided to roll the OTM $360 option prior to expiration to secure additional premiums. Afterwards, the stock hit all-time highs in the fourth quarter due to several consecutive quarterly earnings surprises along with speculation that the company would continue to attract market share and pioneer new technologies. Therefore, we opted to close the option and write new covered calls with a 58% higher strike price for more upside. During each subsequent roll over the next several months, we preferred to keep strike prices elevated to maintain a high level of upside.

But in the second half of 2022, our positive score on TSLA turned negative due to the stock’s rich valuation and relative value against its peer group. In response, and after accreting almost full value on the active option positions, we reduced the strike price on the roll to capture attractive option premiums. By the end of the year, TSLA shares retreated in sympathy with the tech sector. From its peak in November 2021 to its low point in January 2023, TSLA shares experienced a 73% drawdown.

In H1 2023, due to concerns over a prolonged bear market rally and upside volatility for TSLA, we ratcheted strike prices higher to better absorb interim shocks and avoid capping returns on the stock. But given our cautious outlook and slightly negative TSLA score, we believe the current level of strike prices is appropriate and expect covered calls to produce additive returns versus a stock-only portfolio.

Interested in how Concentrated Stock Triple Play may help your portfolio?

Contact your NorthCoast advisor or email us at info@northcoastam.com.